Does it still make sense to "own the bank"?

Almost a year and a half ago I wrote a post on how "owning" the bank can be more profitable than simply putting your money in the bank. I compared the increase in value you'd get from placing $1000 in an ING Direct Savings Maximiser account with buying the equivalent value of stock in four major Australian banks. The comparison showed a return on investment of between around 10% per annum and 17% per annum, which was significantly higher than ING's interest rate of 6%.

That post was written in a time of economic prosperity, and the results reflected the stellar results that stocks had seen in the previous year. Things dramatically changed in November last year, with the ASX 200 dropping in value dramatically to the present day. From a high of 6851 in November the index has dropped to a low of 4758 this month (so far), representing a decline of roughly 30% since November.

In light of this economic change does it still make sense to buy stock?

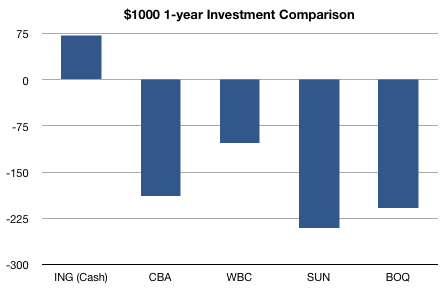

I made the same comparison over the year from 1st August 2007 to 31st July 2008, and the results were the exact opposite of last year's!

In this year, the banks lost a minimum of $100 of a $1000 investment - that's a minimum loss of 10%! The worst performing bank, Suncorp Metway (1), lost $241 or 24%!

ING, in comparison, made a nice steady gain of $70.

This is a perfect reflection of the risk inherent in buying stock. You trade potentially higher gains, for a higher risk of losing money. This risk was definitely realized in the past year.

(Hat tip to HiredGoon of bubblepedia.net.au for getting me thinking about this again.)

(1) Interestingly, Suncorp Metway was also the worst performing bank in my last comparison.

blog comments powered by Disqus